As a 2017 holiday present to taxpayers, Congress passed tax legislation that your representatives, senators and many tax professionals have described as the most significant overhaul of our tax laws since 1986, when President Ronald Reagan’s tax bill was passed. What follows is an overview of those provisions of what was unofficially called the Tax Cuts and Jobs Act of 2017 or “Tax Reform”) which impact special needs planning, special needs trusts and individuals with a disability or their families.

Tax Rates and Brackets

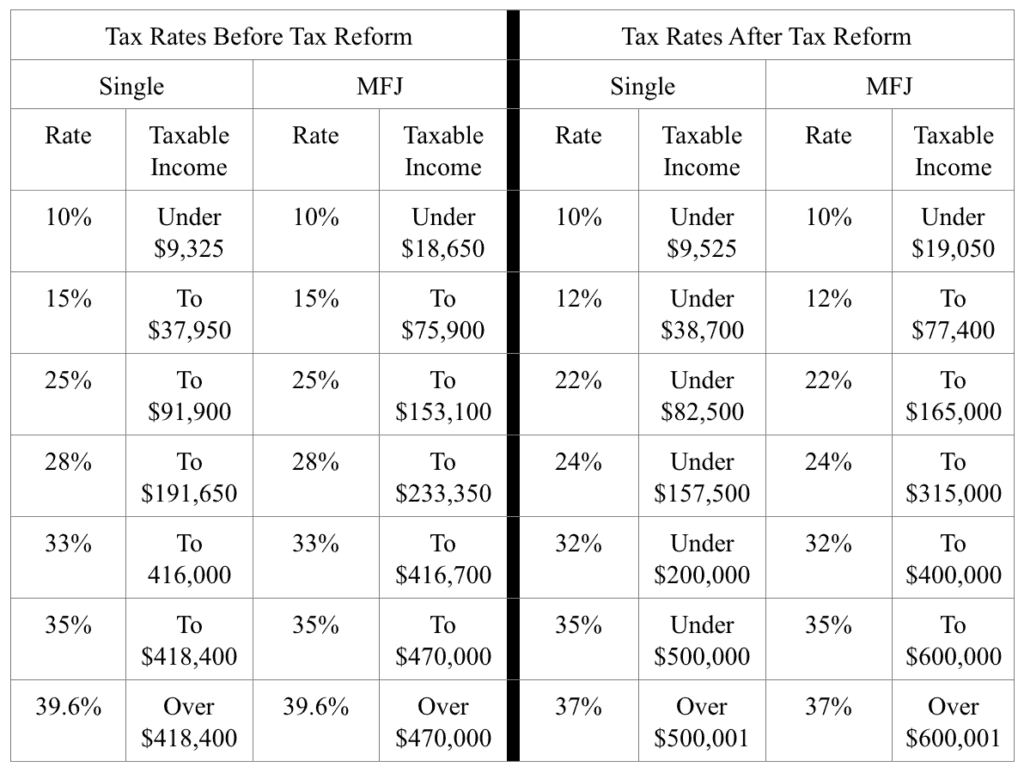

Unfortunately, simplification was not part of 2017’s Tax Reform. While our new tax rates are generally two to three percentage points lower, rates for taxpayers in certain income brackets increase (for example, single individuals with taxable income of between $200,000 and $400,000). Below is a chart comparing the pre- and post-Tax Reform rates for single individuals and for married individuals filing jointly (“MFJ”).

While regular individual income tax rates decreased, capital gain tax rates, qualified dividend tax rates and the net investment income tax rate all remained unchanged.

Individual Tax Benefits Are Only Temporary

While the tax benefits granted corporations are permanent (until changed again by Congress), the individual tax provisions are scheduled to expire after eight years. So, absent additional action by Congress before December 31, 2025, the new individual income tax rules “sunset” and return to their previous structure.

Doubling the Standard Deduction

One of the most highly publicized selling points for Tax Reform was its promise to double the standard deduction for all individual taxpayers. Beginning with 2018, the standard deduction for single individuals increased to $12,000, while the standard deduction for MFJ taxpayers increased to $24,000. The additional annual standard deductions for the elderly and blind remain unchanged.

What did change, though, is that Tax Reform repealed the deduction for personal exemptions (which would have been $4,150.00 in 2018). The result of repealing personal exemptions, while doubling standard deductions is that most families will benefit much less than initially assumed. Instead of tax savings of approximately $12,000 for an MFJ return, the actual tax savings is less than $3,000 per year.

In order to secure needed support for Tax Reform, Congress increased the child tax credit. The increase moves the credit from $1,000 of fully refundable credit to $2,000, of which only $1,400 is refundable. The modified adjusted gross income threshold where the credit is phased out is $200,000 for single and head of household taxpayers and $400,000 for MFJ. The maximum age for a child eligible for the credit remains 16 years old. In addition to increasing the child tax credit, the legislation included a provision for a $500 nonrefundable tax credit for dependent children over the age of 16, as well as all other dependents. In order to be a dependent for tax purposes, the individual must live with the person claiming them for more than six months during the year.

While the above tax provisions changed, many other family tax breaks did not. The child and dependent care expense credit, the adoption credit, and the exclusion for dependent care assistance and adoption assistance under employer plans were unchanged by 2017’s tax legislation.

Changes in Itemized Deductions

Perhaps one of the most visible tax changes is the loss of many itemized deductions. Many were repealed, while others were merely scaled back.

Most important for individuals with a disability and their families is that the deduction for medical expenses survived. In fact, for 2017 and 2018, the deduction will be enhanced, allowing filers to claim expenses exceeding 7.5 percent of their adjusted gross income. Thereafter, the deduction can only be claimed for those expenses which exceed 10% of the taxpayer’s adjusted gross income.

Other itemized deduction changes which may have an impact on an individual with a disability, their family and/or a special needs trust are as follows:

- State and Local Taxes. After 2017, non-corporate taxpayers are only allowed to deduct up to $10,000 each year for state and local property taxes and/or income taxes (or sales taxes in those states which do not impose an income tax). The new law also repeals the deduction for any foreign property taxes paid.

- Mortgage Interest Deduction. Tax Reform reduced the limits on the loan amount for which a mortgage interest deduction can be claimed by individuals, at the same time grandfathering those loans which existed as of December 31, 2017. The mortgage interest which is deductible is limited to the interest on principal of $750,000. The law also repealed the deduction for interest on home equity loans beginning as of 2018.

- Casualty and Theft Losses. The deduction for casualty and theft losses was repealed.

- Charitable Contribution Deductions. Charitable contributions, however, remain available, even for those claiming the standard deduction. The tax law also increased the percentage limit to 60% for cash contributions to public charities.

- Miscellaneous Itemized Expenses. The deductibility of these expenses was repealed.

- Alimony. The deduction, along with the corresponding income reporting by the recipient, was repealed for tax years beginning in 2019.

- Education-related Tax Benefits. These benefits were unchanged.

- The Alternative Minimum Tax. The AMT ─ bane of many middle-income taxpayers ─ unfortunately was not repealed in Tax Reform. It did, however, significantly increase the income level at which the exemption for the alternative minimum tax is phased out.

- The Individual Healthcare Mandate. Tax Reform repealed the penalty on individuals who fail to carry health insurance, a penalty originally enacted as part of the Affordable Care Act (ACA).

Changes In ABLE Accounts

Similar to 529 college savings accounts, ABLE accounts were first enacted by Congress in 2014. ABLE accounts enable individuals with a disability and their families to annually save up to $15,000 (the 2018 cap) and use the contribution, plus any tax-free earnings, for “disability related expenses” without impacting the individual’s eligibility for SSI, Medicaid and any other means-tested public benefits programs.

- Under Tax Reform, families who had set up a 529 account for a child with a disability who is now unlikely, unable or uninterested in attending college are now allowed to “rollover” up to $15,000 per year (the annual contribution limit) from a 529 account to an ABLE account.

- However, families may not need or want to make such a rollover. While 529 account withdrawals were previously limited to college expenses, such accounts can now, after Tax Reform, be used to pay for education expenses in public and private schools for kindergarten through high school (K thru 12), with an annual limit for such qualified distributions being $10,000.

- Tax Reform also opens up ABLE accounts to receive some, or even all of the beneficiary’s earnings, so long as his/her total earnings are below the Federal Poverty limit (and the beneficiary does not participate in his/her employer’s retirement plan). Such contributions can be made on top of the $15,000 annual contribution limit. The Federal Poverty level is $12,060 for a single person in 2018.

- The Saver’s Credit of up to $1,000 is also available to the designated beneficiary of an ABLE account (no one else) for certain contributions to that account. First, the designated beneficiary must be an eligible lower-income taxpayer. Second, because the Saver’s Credit is a non-refundable credit, it is only worthwhile if the designated beneficiary actually owes tax. So, for many designated beneficiaries, it will take a contribution of at least $2,000 to earn the $1,000 credit.

- In addition to the ABLE rollover provisions (which allow a 529 account to be transferred to an ABLE account for the same beneficiary), Tax Reform allows rollovers from a 529 Plan held for the benefit of certain family members of an individual with a disability to an ABLE account for that person. In order to qualify, certain requirements must be met:

- The rollover must take place within 60 days.

- This new rollover provision is counted as part of the $15,000 per year cap on ABLE contributions.

- Any extra amount “rolled over” is treated as income to the Designated Beneficiary.

Tax on the Unearned Income of Children and Certain Dependents

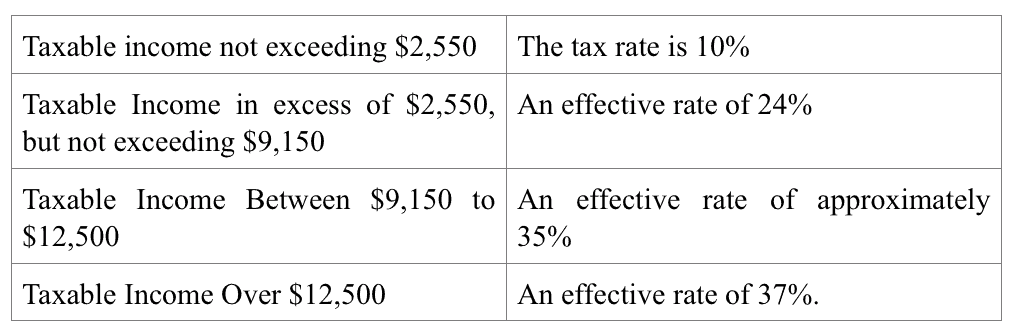

Under Tax Reform, the taxable income attributable to amounts earned by a child, or someone who is a dependent of another for tax purposes, will be taxed as a single taxpayer according to the brackets and the rates. The important change under Tax Reform for those in the disability community is that the net unearned income of an individual claimed as a dependent on another’s return will be taxed according to the rules applicable to estates and trusts.

This change means that much of the income of a child or anyone who is claimed as a dependent by another which is unearned income (a good example would be an individual who has a first-party special needs trust) will be taxable as follows:

Capital gains and qualified dividend rates will continue to be imposed at 15% or 20% tax rates depending upon the amount of unearned income received by the individual.

While the dependency requirement will be met by many individuals with a disability who are receiving SSI, many parents are surprised to learn that in order for a child to be a “tax dependent,” the child must live with the taxpayer for more than one half of the year. Thus, for those living in group homes or similar arrangements, the individual with a disability may not qualify as a dependent of his/her parents for tax purposes. Last but not least, in order to qualify as a dependent, the person with a disability must not have provided more than one half of his or her own support.

Qualified Disability Trusts

Last, is the good news that Tax Reform does not make any changes which impact how a qualified disability trust operates for income tax purposes. In order to be a qualified disability trust:

- It must be irrevocable;

- It must be for the sole benefit of a beneficiary with a disability;

- The beneficiary must be under the age of 65; and

- The beneficiary must have a disability as defined for purposes of SSI and/or SSDI programs.

Qualified disability trusts are an exception with respect to the limits imposed on the amount of income that is exempted from tax for a trust. Under Tax Reform, a qualified disability trust receives a deemed exemption equal to that of a single taxpayer (even though personal exemptions are no longer a tax benefit beginning 2018 and thereafter), which amount is equal to $4,150. Because qualified disability trusts pay tax themselves, distributions from such trusts to a beneficiary who is a dependent on another’s return are not subject to the kiddie tax.

Overall, it appears that individuals with a disability and/or a special needs trust fare no better or worse than other individuals under Tax Reform. However, the usual caveat applies to our discussion of Tax Reform’s impact; each taxpayer should consult with their own tax advisor/professional in order to make sure he/she properly understand these new rules and appropriately analyze the unique circumstances of each.

About this Article: We hope you find this article informative, but it is not legal advice. You should consult your own attorney, who can review your specific situation and account for variations in state law and local practices. Laws and regulations are constantly changing, so the longer it has been since an article was written, the greater the likelihood that the article might be out of date. SNA members focus on this complex, evolving area of law. To locate a member in your state, visit Find an Attorney.

Requirements for Reproducing this Article: The above article may be reprinted only if it appears unmodified, including both the author description above the title and the “About this Article” paragraph immediately following the article, accompanied by the following statement: “Reprinted with permission of the Special Needs Alliance – www.specialneedsalliance.org